TradeKing Advisors, the robo-advisor offering from online broker TradeKing, has been making strides: The company has lowered its account minimums twice since launching, settling on a very reasonable $500. Management fees have also been significantly reduced. The company offers a diversified portfolio of up to 20 asset classes, a wide range of account offerings and integration with TradeKing, a well-respected broker among active traders.

TradeKing Advisors is best for:

- Business accounts

- Existing TradeKing online broker customers

- Hands-off investors

- Automatic rebalancing

TradeKing Advisors at a glance

| Overall |

|

|

| Account management fee |  |

Two portfolio choices: • Core: $1/month for balances under $5,000; 0.25% on $5,000+ • Momentum: 0.50% |

| Investment expense ratios |  |

Expense ratios average 0.17% |

| Portfolio |  |

ETFs and ETNs from up to 20 asset classes |

| Account minimum |  |

$500 for Core portfolio; $5,000 for Momentum |

| Account fees (annual, transfer, closing) |  |

$50 IRA closing fee; no fee to close brokerage account |

| Accounts supported |  |

• Individual non-retirement accounts • Roth, traditional, SIMPLE, SEP and rollover IRAs • Trusts • Coverdell and UTMA accounts • Business accounts |

| Tax strategy |  |

Not offered |

| Automatic rebalancing |  |

Free on all accounts |

| Customer support |  |

Phone, email and live chat support Monday-Friday 8 a.m.-6 p.m. Eastern |

Where TradeKing Advisors shines

Investments: TradeKing Advisors has a relationship with Ibbotson Associates, the registered investment advisor arm of Morningstar. Although TradeKing Advisors is only about 2 years old, Ibbotson Associates has more than $105 billion in assets under management and a proven track record. The company reviews and updates the TradeKing Advisors investment portfolios, which are constructed of exchange-traded funds and exchange-traded notes that carry an average expense ratio of 0.17%.

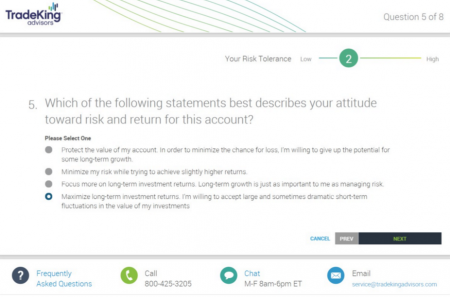

New customers are directed to an assessment; the eight questions, developed by Ibbotson, determine an investor’s risk tolerance and goals and help the firm select an investment strategy for the client.

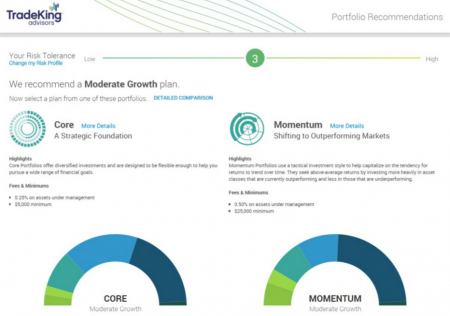

The questions gauge how comfortable investors are with large portfolio fluctuations and what their investment time horizon is; the assessment then suggests one “Core” portfolio and one “Momentum” portfolio, with details about the allocation of each.

Core has a minimum investment of just $500 and offers five portfolio choices, covering both conservative and aggressive options with up to 17 asset classes, including domestic and foreign fixed income securities, equities and real estate. Momentum also offers five options from conservative to aggressive, with up to 20 asset classes. Momentum portfolios are managed more actively and are intended to capture the momentum of the market — investing in asset classes that are currently outperforming and cutting back investments in classes that are underperforming. All portfolios are monitored daily and automatically rebalanced as needed.

Integration with TradeKing: Current TradeKing self-directed account holders can open a TradeKing Advisors account and easily view all of their accounts in one place. The platform is also mobile-responsive and consistent across devices. You cannot, however, combine self-directed and managed accounts, and TradeKing Advisors’ minimum balance requirements are separate from any assets held at TradeKing.

Business accounts: TradeKing Advisors offers account options that many other robo-advisors don’t, including LLC, partnership, sole proprietorship and corporate accounts.

Where TradeKing Advisors falls short

Management fees: TradeKing Advisors has nudged its fees down since its launch in 2014. Core portfolios carry a $1 a month flat fee for balances under $5,000, and a 0.25% management fee on balances $5,000 or above. Investors who select Momentum portfolios are charged a 0.50% management fee. The Core portfolio costs are fairly competitive, but Momentum carries a hefty price tag — yes, that portfolio is more actively managed, but most robo-advisors who hit this kind of fee also offer clients elevated service, including access to financial advisors.

TradeKing Advisors Core portfolio clients can also add a feature called RiskAssist to their account, which tacks on an additional 0.50% annual fee, bringing the total yearly management cost to 0.75% (or $1 a month plus 0.50% on balances below $5,000). That’s a very high price for peace of mind: Risk Assist automatically shifts asset allocation away from equities and into fixed-income ETFs during severe market declines (like the 2008 recession). As the market bounces back, the allocation will as well, gradually shifting back into equity ETFs. This is an optional feature, so it’s not really a negative; however, it adds a significant cost to the management fee, and investors with a long time horizon would be wise to simply stay the course during a market downturn.

Cash holdings: Investors with TradeKing Advisors will find uninvested cash in their portfolios — between 1% and 6%, depending on the portfolio’s allocation. The advisor does this to avoid having to sell investments to cover management fees, and because cash is a part of some allocations. Investors with greater risk tolerance may prefer a robo-advisor that invests in fractional shares, such as Betterment.

Tax-loss harvesting: Or rather, the lack thereof. The company doesn’t offer this feature, which is standard at many robo-advisors.

The bottom line

TradeKing Advisors hits a higher price point than many other robo-advisors — particularly for its Momentum offering — and it doesn’t separate itself from the pack enough to justify the cost. Investors with taxable accounts could miss out on valuable tax-loss harvesting opportunities here. That said, it is worth a look for IRA account holders who won’t miss that feature, as well as existing TradeKing clients who will appreciate the ability to view and manage all of their accounts at once. TradeKing Advisors may also appeal to investors looking to open business accounts, which generally aren’t offered by robo-advisors.

No comments:

Post a Comment