They did it again. Mortgage rates dipped for the sixth week in a row — just above the 2015 low of 3.59% — thanks to a still-volatile stock market. Meanwhile, a lack of housing inventory is putting the squeeze on potential homeowners who risk being sidelined by increasing home prices and too few homes to choose from.

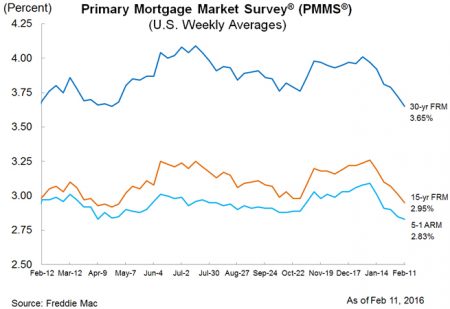

Freddie Mac’s just-released weekly survey of lenders shows the following average rates for the most popular home loan terms:

- 30-year fixed-rate mortgages averaged 3.65% with an average 0.5 point for the week ending Feb. 11, 2016. A year ago, the rate averaged 3.69%.

- 15-year fixed rates averaged 2.95% with an average 0.5 point. The same term priced at 2.99% a year ago.

- 5-year adjustable-rate mortgages priced at 2.83% with an average 0.4 point. Last year at this time, the same ARM averaged 2.97%.

In a falling rate environment, mortgage rates often adjust more slowly than capital market rates, and the early 2016 flight-to-quality has run true to form,” Sean Becketti, chief economist for Freddie Mac, said in a release. “The 30-year mortgage rate has dropped 36 basis points since the start of the year, while the yield on the 10-year Treasury has dropped 59 basis points over the same period. If Treasury yields were to hold at current levels, mortgage rates might well sink a little further before stabilizing.”

Mortgage applications rose 9.3% for the week ending Feb. 5 from the week prior, according to the Mortgage Bankers Association weekly report.

Purchase applications were up 0.2%, as refi applications soared by 16%. Overall, home purchase loan applications remain 25% higher than the same week one year ago.

Low inventory creating bottleneck for potential buyers

Hopeful homebuyers are becoming increasingly sidelined by a lack of available homes on the market, and it’s a problem that’s here to stay, according to a new report from the National Association of Realtors.

Fewer homes on the market pushed the median existing single-family home price up in 81% of measured markets, with 145 out of 179 metro housing markets showing increases based on fourth-quarter closings, the association reported.

That means housing options are shrinking, which is sidelining a lot of potential buyers, said Lawrence Yun, NAR chief economist, in a release.

“Even with slightly cooling demand, the unshakeable trend of inadequate supply in relation to the overall pool of prospective buyers inflicted upward pressure on home prices in several metro areas,” Yun said. “As a result, homeownership continues to be out of reach for a number of qualified buyers in the top job-producing, but costliest, parts of the country — especially on the West Coast and parts of the South.

“Without a significant ramp-up in new home construction and more homeowners listing their homes for sale, buyers are likely to see little relief in the form of slowing price growth in the months ahead.”

If you want to buy a single-family home at the national median price of $222,700 and have 5% for a down payment, you’ll need an income of nearly $50,000 a year to afford the cost of homeownership.

More from NerdWallet:

Deborah is a staff writer at NerdWallet, a personal finance website. Email: dkearns@nerdwallet.com. Twitter: @debbie_kearns.

No comments:

Post a Comment