Editor’s note: NerdWallet’s Step by Step series gives small-business owners a behind-the-scenes look at the loan application process for various online lenders. We show you what you can expect screen by screen as you submit your application.

Table of contents

Lending Club loan application summary

Pre-qualification

Loan quote

Providing business bank account information

Submitting required documents

Verifying email address, bank account

Final review and funding

To apply at Lending Club

Lending Club began offering business loans in early 2014 and business lines of credit in 2015. The company is a good option for business owners who prefer the convenience of online lending and those who can’t wait several months for a bank loan or don’t qualify due to less-than-perfect credit.

Lending Club loan application: Summary

- Time: Pre-qualification can take as little as five minutes. If you pre-qualify, you must gather and submit supporting documents. Subsequent funding takes about a week.

- Documents needed:

- Most recent three months of business bank account statements

- IRS Form 4506-T, which authorizes Lending Club to obtain your business’s tax transcripts from the IRS

- Previous years’ business tax return

| Lending Club Funding Options at a Glance | ||

|---|---|---|

| Type of loan | Term loan | Line of credit |

| Cost of funding |

|

|

| Loan amount |

|

|

| Loan term | 1 - 5 years | 25 months |

| Minimum qualifications | Two years in business, $75,000 in annual revenue, 20% ownership of business, a personal credit score of 600, collateral for loans of more than $100,000 | |

| Typical funded borrower | Personal credit score of 700, 11 years in business, annual sales of a little more than $1 million | |

|

Learn More |

||

Note: Lending Club is unavailable to borrowers in Iowa and Idaho.

Lending Club loan application: Step by step

1. Pre-qualification

Time: 5 minutes

Documents needed? No

Potential borrowers can get a rate quote for a Lending Club loan or line of credit in about five minutes without affecting their credit scores.

First, you’ll enter your desired loan amount and explain why you need the money. You can choose among debt consolidation, an inventory or equipment purchase, working capital, remodeling, business acquisition, marketing, or emergency repairs, or you can manually enter another business purpose. The company provides up to $300,000 for loans and credit lines.

You’ll then be asked for some basic information about your business — including its address, phone number, number of employees and legal structure (limited liability company, C or S corporation, sole proprietorship or partnership) — and create a Lending Club login with password.

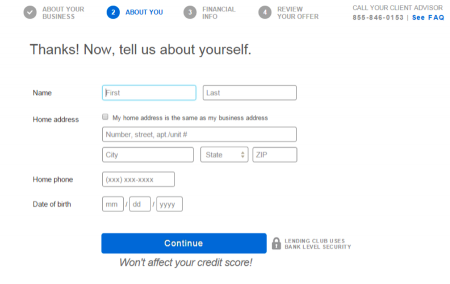

Next, Lending Club will ask you for some personal information:

Before you receive your quote, you’ll provide financial details about your business: gross sales in the last year, net profit before taxes, personal annual income, percent ownership of the business, and monthly payment amounts for any commercial real estate loans or leases, equipment and vehicle leases, and other business lines and loans.

Lending Club will check your credit after you complete this step — but because it’s a “soft pull,” not a hard inquiry, it won’t lower your credit score. (Note: Your credit score will be affected if you get approved and accept the loan.) The average credit score of its borrowers is about 700, according to Lending Club.

2. Loan quote

Time: Instant

Documents needed? No

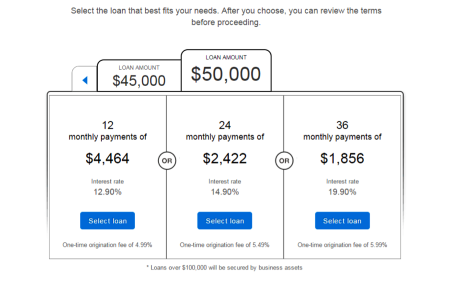

If you pre-qualify for the term loan, Lending Club will immediately quote you a loan amount and three repayment terms: 12, 24 or 36 months. You’ll see the interest rate for each, as well as a one-time origination fee — a percentage between .99% and 6.99% that will be deducted from your loan proceeds — and your fixed monthly payment amount.

Nerd note: Remember the interest rate alone does not represent the true cost of borrowing. The annual percentage rate, or APR, represents all borrowing costs, which include interest rates, origination fees and any other charges.

This quote should stick unless Lending Club can’t verify the information on your application, says Tom Green, Lending Club’s vice president of small-business lending. “For most borrowers,” he says, “the pre-qualification quote received is exactly what they get.”

If you choose a shorter repayment term, you’ll have a higher monthly payment, but a lower interest rate; longer repayment terms carry a lower monthly payment and a higher interest rate.

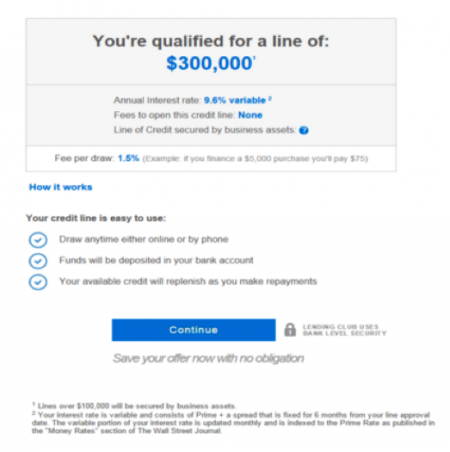

If you pre-qualify for the line of credit, Lending Club will quote you the maximum amount you can borrow, the variable annual interest rate and the fees you’ll pay each time you draw. There are no fees to open the line of credit and you can draw on it anytime, either online or over the phone.

If you don’t qualify, Lending Club will tell you immediately and provide a reason for the denial. You can apply again if you later meet the company’s requirements; you won’t be penalized if you were denied in the past.

If you apply for a loan or line of credit of more than $100,000, Lending Club requires collateral in the form of a UCC-1 lien on your business assets. This means that Lending Club has priority over other lenders to recoup its debt if your business defaults.

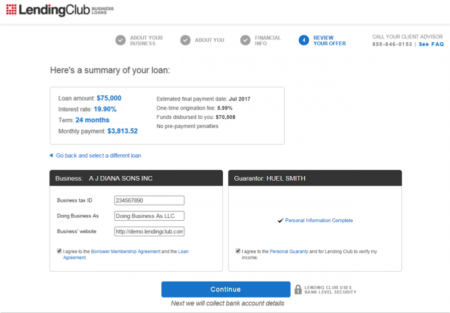

On the next page, you’ll receive more details about your offer, including the estimated final payment date and the total amount of funds you’ll receive upon closing, factoring in the origination fee.

In this case, a loan amount of $75,000 and an origination fee of 5.99% (or $4,492.50) leaves the borrower with $70,508 at closing. The borrower will pay an interest rate of 19.90% over the 24-month loan term, with monthly payments of $3,813.52. The APR in this example is 26.42%.

On this screen, you also need to enter your business’s tax ID, corporate structure and the address of its website, and sign off on a personal guaranty. Read the document by clicking the link, then check off the box. The guaranty is in addition to the UCC-1 lien. It holds you personally responsible for repayment in the event that the business fails to repay the loan, or your assets fail to cover a default.

3. Provide bank account information

Time: A few minutes

Documents needed? No

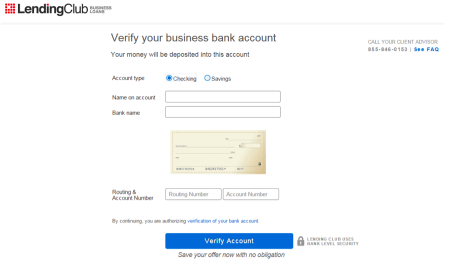

In this step you can choose to have your loan deposited into either a business checking or savings account. Provide the name of the bank, the name on the account, and its routing and account numbers. (The account is verified in Step 5.)

This is also the account from which Lending Club will withdraw your payments; you can change it later if you need to, Green says.

4. Submit required documents

Time: Less than an hour, if you’re ready to submit the required documents digitally

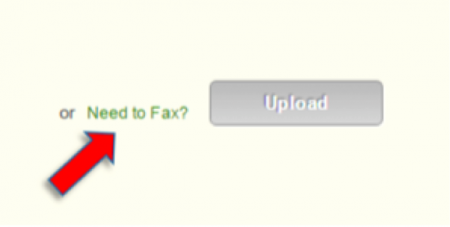

The longest delay in this step tends to be for borrowers who don’t have copies of their tax returns and need to get them from an accountant, according to Green. Emailing or faxing the documents also can add time to the process, but 60% of the company’s borrowers use one of those two methods.

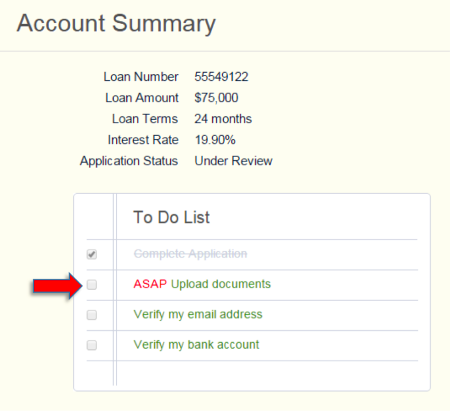

Your application is under review while you submit the documents.

Nerd note: Lending Club recently instituted a “small ticket policy” that reduces the number of documents business owners need to provide if they’re applying for loans of $5,000 to $15,000. Some borrowers may not have to provide any. This shortens the overall time to funding.

If you have questions at this point, you can call a business loan manager at the number in the top right corner of the screen.

Once you’ve faxed the documents, it should take three business days to receive an update on your loan status.

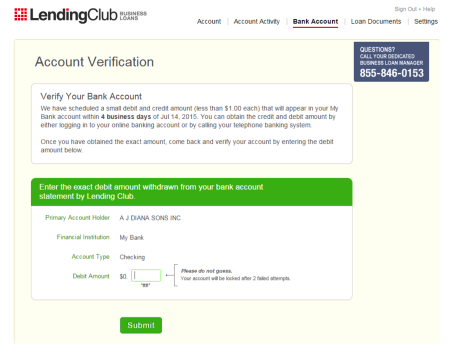

5. Verify email address, bank account

Time: 1 day

Documents needed? No

The next step is to verify your email address and bank account.

After verifying your account, you’ll have access to a tab called “Loan Documents” that contains your borrower membership agreement, commercial loan agreement, and the personal guaranty you signed during the application. You can view them, but there’s nothing you need to do with them at this stage.

If you click on the “Settings” tab, you can view your user profile, which includes your personal and business information.

Final review and funding

Time: Five to seven days

Documents needed? No

Lending Club now performs a final review of your application. If the company can verify your information and believes you’re able to repay the loan or credit line, it will offer you funding. If you accept, Lending Club will make a hard inquiry on your credit report.

Once that’s complete, the loan is ready to fund. Lending Club will call to let you know that the money is on the way and to answer any final questions you may have.

Funds are typically sent within five days, but may not be available in your bank account for another day or two, Green says. Larger loans may take a week or more due to a longer review process, he says.

To apply

If you’re ready to get started with Lending Club, apply on the lender’s secure site:

Find and compare small-business loans

NerdWallet has come up with a list of the best small-business loans to meet your needs and goals. We gauged lender trustworthiness, market scope and user experience, among other factors, and arranged the loans by categories that include your revenue and how long you’ve been in business.

Steve Nicastro is a staff writer at NerdWallet, a personal finance website. Email: Steven.N@nerdwallet.com. Twitter: @StevenNicastro.

No comments:

Post a Comment