Mortgage rates have hit a new 2016 low, which is making everyone wonder just how low they will go. Meanwhile, vacation home sales cooled considerably last year, and investors scooped up more properties in 2015 to capitalize on a booming rental market.

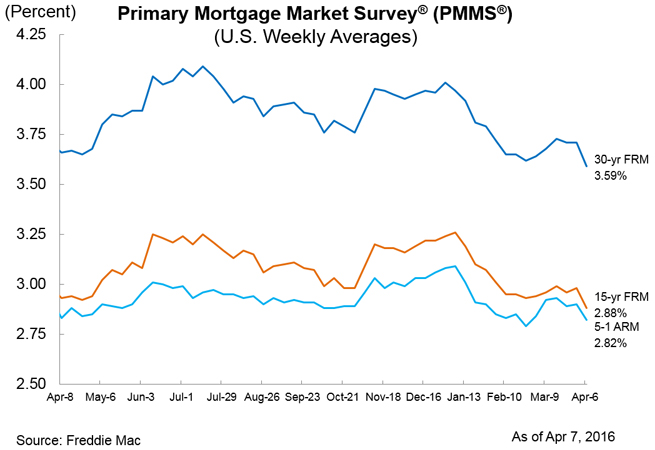

Freddie Mac’s just-released weekly survey of lenders shows the following average rates for the most popular home loan terms:

- 30-year fixed-rate mortgages averaged 3.59% with an average 0.5 point for the week ending April 7, 2016. A year ago, the rate averaged 3.66%.

- 15-year fixed rates averaged 2.88% with an average 0.4 point. The same term priced at 2.93% a year ago.

- 5-year adjustable-rate mortgages priced at 2.82% with an average 0.5 point. Last year at this time, the same ARM averaged 2.83%.

“Mortgage rates this week registered the delayed impact of last week’s sharp drop in Treasury yields as the 30-year mortgage rate fell 12 basis points to 3.59%,” Sean Becketti, chief economist for Freddie Mac, said in a release. “This rate marks a new low for 2016 and matches last year’s low in February 2015. Low mortgage rates and a positive employment outlook should support a strong housing market in the second quarter of 2016.”

Meanwhile, mortgage application volume edged 2.7% higher, according to the Mortgage Bankers Association report for the week ending April 1, 2016.

Purchase applications dipped 2%, as refi applications rose by 7%. Overall, home purchase loan applications remain 11% higher than the same week one year ago.

Investment home sales up; vacation home purchases cool in 2015

Tighter inventory of bargain-priced homes put a big damper on vacation home sales, while investment property purchases saw gains in 2015 for the first time in five years, according to a new survey from the National Association of Realtors.

Vacation-home sales dipped by 18.5% percent last year to 920,000, down from 1.13 million in 2014, according to NAR’s 2016 Investment and Vacation Homebuyers Survey. With more baby boomers nearing retirement and seeking warmer locales in the South, there aren’t enough affordable homes on the market to meet the higher demand.

Investment buyers, though, snapped up more properties in 2015 to the tune of 1.09 million sales, an increase of 7% year over year. The investment sales boost was due in large part to investors seeing more stability and price appreciation and returning to the housing market.

“Despite a smaller share of distressed properties coming onto the market, investment purchases reversed course in 2015 after declining for four straight years,” NAR chief economist Lawrence Yun said in a release. “Steadily increasing home prices and strong rental demand appear to be giving more individual investors assurance that purchasing real estate will diversify their portfolios and generate additional income if they decide to rent out the home.”

More from NerdWallet

How much house can I really afford?

Compare mortgage rates

Find a mortgage broker

Deborah Kearns is a staff writer at NerdWallet, a personal finance website. Email: dkearns@nerdwallet.com. Twitter: @debbie_kearns.

Image via iStock.

No comments:

Post a Comment