Launched in 2011, Wealthfront is one of the biggest players in the robo-advisor movement, with just under $3 billion in assets under management. The company has built clients’ trust by offering free management on the first $10,000 invested, which understandably attracts beginner investors. But Wealthfront plays to larger balances, too, particularly taxable accounts: Its direct indexing service, available on accounts over $100,000, purchases individual securities to zero in on tax-loss harvesting opportunities. Combined with daily tax-loss harvesting included in all taxable accounts, the company says the service can add as much as 2% to annual investment performance.

Launched in 2011, Wealthfront is one of the biggest players in the robo-advisor movement, with just under $3 billion in assets under management. The company has built clients’ trust by offering free management on the first $10,000 invested, which understandably attracts beginner investors. But Wealthfront plays to larger balances, too, particularly taxable accounts: Its direct indexing service, available on accounts over $100,000, purchases individual securities to zero in on tax-loss harvesting opportunities. Combined with daily tax-loss harvesting included in all taxable accounts, the company says the service can add as much as 2% to annual investment performance.

Quick facts

- Management fee: 0.25%, but first $10,000 is free

- Account minimum: $500

- Promotion: NerdWallet readers get $15,000 managed for free

Wealthfront is best for:

- Hands-off investors

- Free management on small balances

- Superior tax efficiency for taxable accounts

- Automatic rebalancing

Wealthfront at a glance

| Overall |

|

|

| Account management fee |  |

First $10,000 managed for free; 0.25% after that |

| Investment expense ratios |  |

ETF expense ratios average 0.12% |

| Portfolio |  |

ETFs from 11 asset classes |

| Account minimum |  |

$500 |

| Account fees (annual, transfer, closing) |  |

None |

| Accounts supported |  |

• Individual and joint non-retirement accounts • Roth, traditional, SEP and rollover IRAs • Trusts |

| Tax strategy |  |

Daily tax-loss harvesting on all taxable accounts; direct indexing on accounts over $100,000 |

| Automatic rebalancing |  |

Free on all accounts |

| Customer support |  |

Phone support Monday-Friday 11 a.m. to 8 p.m. Eastern; email support |

| Promotion |  |

NerdWallet readers receive free management on the first $15,000 invested |

Where Wealthfront shines

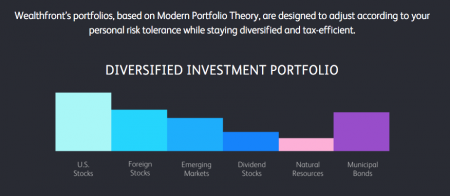

Investments: Wealthfront has employed some heavy hitters to get its investment strategy in place, including Chief Investment Officer Burton Malkiel, senior economist at Princeton and author of “A Random Walk Down Wall Street,” an investing classic. The company’s methodology includes giving investors a streamlined questionnaire to identify risk tolerance, then employing exchange-traded funds in 11 asset classes.

The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations necessitate it. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule.

Wealthfront’s investment mix covers U.S. stocks; foreign stocks; emerging markets; dividend stocks; real estate; natural resources; treasury inflation-protected securities; and U.S. government, corporate, municipal and emerging market bonds.

Management fees: The first $10,000 invested with Wealthfront is managed for free. After you pass that threshold, that $10,000 is still managed for free, but assets invested beyond that are charged a flat advisory fee of 0.25%.

By contrast, the company’s biggest competitor, Betterment, charges a tiered management fee based on account balance that ranges from 0.15% to 0.35% (for a full description of that company’s fees, read our Betterment review). That can make it difficult to compare costs between the two. Here’s how the advisors’ management fees stack up at various account sizes:

| Account balance | Wealthfront management fee |

Betterment management fee |

Wealthfront annual cost |

Betterment annual cost |

|---|---|---|---|---|

| $5,000 | None | 0.35% (or $3/month without auto-deposit) | $0 | $17.50 (or $36) |

| $75,000 | 0.25% | 0.25% | $162.50 | $187.50 |

| $100,000 | 0.25% | 0.15% | $225 | $150 |

| $150,000 | 0.25% | 0.15% | $350 | $225 |

Wealthfront also has a referral program — if you invite friends and they fund an account, the company will waive fees on an additional $5,000 for each of you. Investors who use NerdWallet’s Wealthfront promotion receive the same deal, getting free management on $15,000 rather than $10,000.

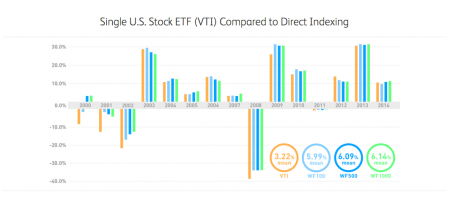

Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. For accounts with balances over $100,000, it offers a service called tax-optimized direct indexing, which is essentially beefed up tax-loss harvesting. The basics: It’s harder to use tax-loss harvesting when you’re purchasing an index, so Wealthfront replicates the index by buying the stocks held in it directly; then its software can look for individual tax-loss harvesting opportunities. That tax savings can be reinvested, which compounds the potential impact of the service.

Portfolio review tool: Wealthfront launched this free tool at the beginning of 2016; it’s available to all investors, not just Wealthfront clients, free of charge. The tool evaluates an investor’s portfolio based on fees, taxes, cash drag and diversification, returning a customized report that can help users optimize their investment strategy and lower fees. The tool only looks at taxable accounts, but the company plans to add the ability to analyze retirement accounts in the future.

Where Wealthfront falls short

No large balance discounts: Wealthfront charges a flat 0.25% management fee after the first $10,000 that is managed for free. That makes it a competitive choice for clients who have less than $100,000 to invest. Cross that threshold, however, and you’ll be eligible for Betterment’s 0.15% fee tier.

Wealthfront does offer the aforementioned tax-optimized direct indexing as a value-add to accounts over $100,000; that can help offset the fee difference on taxable accounts. But tax-advantaged accounts such as IRAs don’t benefit from that service, so for accounts over $100,000, Betterment is the clear winner when it comes to fees.

Cash balance: Wealthfront doesn’t purchase fractional shares of ETFs — which prevents the company from investing your entire deposit — and maintains a cash balance equal to the fees a client is projected to owe over the next year, so accounts are likely to experience a small level of cash drag. The percentage held in cash isn’t nearly as high as Schwab’s allocation, which holds a minimum of 6%, but it’s worth noting for investors who would prefer fractional shares.

The bottom line

The pros far outweigh the cons for Wealthfront, particularly for investors looking to open their first retirement or brokerage account. Free access to active management for the first $10,000 from a proven leader in the robo-advisor field is difficult to beat. Once account balances top $100,000, however, it may be worth shopping around, particularly for investors with tax-advantaged accounts that won’t benefit from Wealthfront’s advanced tax efficiencies.

Arielle O’Shea is a staff writer at NerdWallet, a personal finance website. Email: aoshea@nerdwallet.com. Twitter: @arioshea.

No comments:

Post a Comment