It’s no secret 2016 started off in precarious fashion as several U.S. stock indices tumbled on news of China’s slowing economy, weakening international crude oil prices, and quietly transmitted rumors of a looming recession. Upon these revelations and other market performance indicators, the FOMC announced last week “to maintain the target range for the federal funds rate at ¼ to ½ percent” in accordance with “its objective of maximum employment and 2 percent inflation.” This was a data dependent decision by the FOMC in part because “economic growth slowed last year.”

Unfortunately on January 28th more troubling news surfaced from abroad as The Bank of Japan (BOJ) communicated interest rates are going “minus 0.1%” causing the yen to weaken further against the dollar. This is bad news for U.S. exports in view of an existing trade imbalance between the two allies, which may now expand disproportionately in favor of Japan. So it appears achieving U.S. economic stability-prosperity is unlikely for the foreseeable future given the instability of domestic variables and a myriad of global marketplace pressures.

Additionally there are intensifying investment uncertainties over the domestic real estate market. According to market analyst Marc Hanson, “housing prices…are about 25% to 60% above what the fundamentals of the U.S. economy can justify” and suggests “taking out no more mortgage debt than would result in a maximum debt-to-income ratio of 43%.”

Additionally there are intensifying investment uncertainties over the domestic real estate market. According to market analyst Marc Hanson, “housing prices…are about 25% to 60% above what the fundamentals of the U.S. economy can justify” and suggests “taking out no more mortgage debt than would result in a maximum debt-to-income ratio of 43%.”

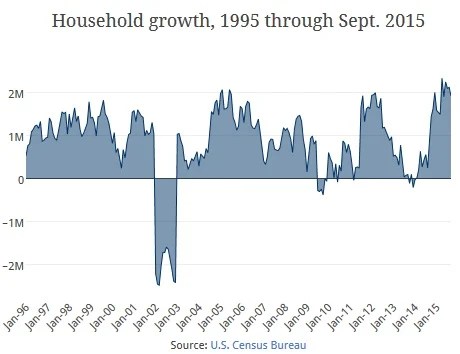

While the subprime mortgage-backed securities (MBS) debacle that catapulted America’s economy into the Great Recession is of little concern now a study by Moody’s Investors Service suggests “for every 10% decline in house prices (in real terms), GDP falls by around 4% from its pre-peak path” noting “property price downturns since 2006 have been linked to a larger fall in GDP.” Terrifying words since the U.S. Census Bureau compared homeownership rates in 2014 to 2015 and the result was a leveling off of purchase activity. Thus as the Fed advances normalizing monetary policy, thereby increasing the federal funds rate and driving up the cost of mortgage money, it is reasonable to anticipate the possibility of housing investment to succumb to a cooling off period.

function updateButtonCount(id){

jQuery.ajax( {

url : object_social_twitter_quote.ajax_url,

data : {post_id:id,action:’updateCountButtonSocialTwitterQuote’},

dataType : ‘json’,

method : ‘POST’,

success : function(response){

console.log(response);

}

});

}

The post Is U.S. Housing Investment Under Threat of an Impending Slowdown? appeared first on Dyer News.

No comments:

Post a Comment